Benefits are an important part of any employee’s compensation package. Having the right benefits plan can help your business achieve its goals, attract top talent, and maximize productivity. Do you know which benefits are the most important for your employees?

Sanofi Canada recently released their 2016 Canada Healthcare Survey, which has proven itself a valuable tool since being introduced in 1998 for benefit administrators making decisions about the kinds of coverage their plans will provide.

We’ve highlighted some Sanofi’s findings and their suggested tips for plan administrators:

Results from Sanofi’s 2016 Healthcare Survey

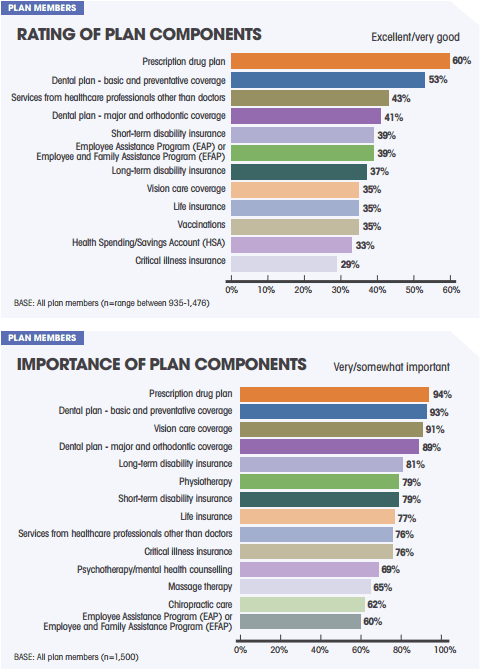

One of the first questions Sanofi asked when surveying plan members was how they would rate the components of their current plans. The two highest-ranking features that emerged were prescription drug and basic dental coverage. 63% of respondents rated prescription drug coverage as very good, while 53% did the same for basic dental.

One of the first questions Sanofi asked when surveying plan members was how they would rate the components of their current plans. The two highest-ranking features that emerged were prescription drug and basic dental coverage. 63% of respondents rated prescription drug coverage as very good, while 53% did the same for basic dental.

Sanofi also asked respondents to rank how important individual components were to them. Again, prescription drug and basic dental coverage came out on top at 94% and 93% respectively. Alignment here is a good thing, as it indicates employees are getting what they need out of their benefits plans.

But what about in cases where that alignment isn’t found?

- 91% of respondents said vision care was a very important part of their benefits package, but only 35% said their current coverage is excellent or very good. Even more, 21% describe their coverage as poor or very poor – one of the highest relative failure rates among all benefits surveyed.

- Although major dental care isn’t common coverage for many smaller companies, it still comes in fourth place for importance at 89% and fourth again for satisfaction, with 41% reporting their current coverage being excellent or very good. There is some room for improvement in this category – with 17% of respondents describing the structures in place for them as poor or very poor – though the contrast is not as stark as it is with vision care.

- Healthcare spending accounts (HSAs) were low on the priority lists for many respondents, with only 33% identifying them as very important and 24% saying they had no opinion. Often this perceived lack of importance is due to poor awareness and underutilization. HSAs are designed to cover incidental costs – including vision care and dental – making them a major asset for all employees.

Another area of significant popularity for respondents was massage therapy, with 43% of members having submitted a claim for it in the past year. Although most employees get massage therapy to address a specific ailment, 38% use massage treatments to relieve general tension and stress.

Other wellness-centred initiatives companies can undertake are flexible working arrangements (of which 41% of respondents said they would take advantage of), off-site fitness classes or gym memberships (36%), nutritious food and snacks in the workplace (36%), and at-work flu shots (35%).

What Do Plan Administrators Think About Their Benefit Plans?

The biggest concern for today’s plan administrators is increasing cost of coverage. Of those surveyed, 66% said their costs had increased over the past three years while 80% expressed concern that their costs would exceed the rate of inflation over the next three to five years.

In some cases, increasing awareness addresses those concerns. For example, less than 50% of plan administrators surveyed said they had an excellent understanding of measures they could take to manage prescription drug coverage – the main cost driver. Other times, it’s about working with their benefits partner to make adjustments to their plan to ensure it both meets their business’s needs and keeps a handle on costs.

Click here to learn how to make the most of your prescription drug coverage.

What Do the Results Mean for Benefit Plan Administrators?

For plan administrators, these results provide an opportunity to reflect on the effectiveness of your current coverage and find opportunities for change:

- Identify Areas of Improvement: Although these results aren’t necessarily representative of every workplace, they can help you identify gaps. If you’d like to know more about what your own employees think about their benefits plans, circulate a survey inviting them to rank their benefits. If you identify misalignment between what they need and what they have, you can take proactive steps to remedy this.

- Focus on Reducing Stress and Improving Productivity: Oftentimes this means focusing on preventative benefits. Massage therapy is an excellent example. Although medical evidence about its effectiveness at relieving tension long-term is mixed, employees perceive it as being a helpful tool to reduce and manage their stress. Remember that a lack of medical proof doesn’t necessarily mean a lack of value.

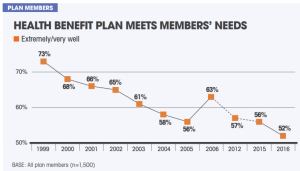

Work on Meeting Your Employees’ Needs: According to Sanofi’s results, benefit plans are at an all-time low when it comes to satisfying their members’ needs. In 2016, only 52% said their needs are met very or extremely well. That can be compared to 63% in 2006 and 73% in 1999. This trend is likely indicative of changing needs among employees and is something plan administrators should seek to gauge among their own teams.

Work on Meeting Your Employees’ Needs: According to Sanofi’s results, benefit plans are at an all-time low when it comes to satisfying their members’ needs. In 2016, only 52% said their needs are met very or extremely well. That can be compared to 63% in 2006 and 73% in 1999. This trend is likely indicative of changing needs among employees and is something plan administrators should seek to gauge among their own teams.

In today’s workplace climate, plan administrators are focusing on creating plans that allow for more personal engagement from employees to create happier, healthier, more relaxed workplaces without going overboard on costs. Working with your benefits partner can help you walk that tightrope – designing customized solutions that deliver the best benefits for your company and employees alike.

HFG is happy to sit down with you and discuss your group insurance needs, goals, and budget. We will provide you with a detailed analysis of which benefits plans best suit your needs. Get in touch with an HFG advisor today to get started!

Read more:

- How a Pooled Benefits Plan Offers Stability for Small Businesses [Video]

- 5 Questions Small Businesses Need to Ask when Choosing a Benefits Plan

- 7 Questions to Ask when Choosing a New Benefits Advisor

- Do You Know Which Benefits Your Employees Like Best? - August 4, 2016

- 4 Little-Known Ways to Cash in on Your Life Insurance Policy - April 20, 2016

- Join Us for a Complimentary ORPP Webinar: What Employers Need to Know - March 29, 2016