Simple. Stable. Smart.

The Chambers Plan operates on a not-for-profit basis, offering businesses rate stability and comprehensive benefits.

As the exclusive provider for the Toronto Board of Trade, Oakville Chamber of Commerce, Burlington Chamber of Commerce, and Mississauga Board of Trade, HFG ensures your business gets the best support and coverage.

Get started with a customized Chambers Plan for your business – speak to our Advisors now!

Outstanding Service with Stable Rates

Why Choose the Chambers Plan?

The Chambers Plan is a pooled or partially pooled plan that runs on a not-for-profit basis. With over 32,000 companies enrolled, the Chambers Plan offers stable rates, user-friendly technology, and excellent service.

Pay for Benefits. Not Profit Margins.

Our Trusted Chamber Plan Partners

Outstanding Service with Stable Rates

Why Choose the Chambers Plan?

The Chambers Plan is a pooled or partially pooled plan that runs on a not-for-profit basis. With over 32,000 companies enrolled, the Chambers Plan offers stable rates, user-friendly technology, and excellent service.

Pay for Benefits. Not Profit Margins.

How the Chambers Plan Works

With over 32,000 participating companies, this not-for-profit program reinvests surpluses to lower premiums further, providing cost-effective and reliable benefits for your business and employees.

Invest in your Employees

Flexible Spending Accounts

Integrate additional flexibility in your plan design with Healthcare Spending Accounts (HSAs) and Lifestyle Spending Accounts (LSAs). HSAs allow employees to top-up health and dental benefits. LSAs support a wide range of wellness needs, such as fitness memberships, daycare, travel expenses, and pet care. As a business, benefit from an easy set-up and a pay as you go structure.

Beyond The Benefits

Unlock these additional benefits included in every plan design when you enroll your business with the Chambers Plan:

Additional Benefits At Your Fingertips

Teladoc – virtual medical experts at your service

Arcora – access to Arcora’s Healthy Business Bookmark and Business Assistance Service

Pocketpills – additional drug coverage on prescriptions filled through pocketpills (excludes QC)

HUGR – unlock connections with others on HUGR’s guided mental wellness and connectivity app

Payworks – integrate Canada’s leading payroll service into your benefits plan

Johnston Group Retiree Plans

For many people, retiring means leaving their group health and dental coverage behind. While provincial plans cover some health care expenses, many day-to-day, travel, and emergency expenses will now be your responsibility.

The Johnston Group Retiree Plans allow owners, principals, and employees to transition from the Chambers Plan to an individual health and dental plan without medical questions if applied for within 60 days following the date of retirement.

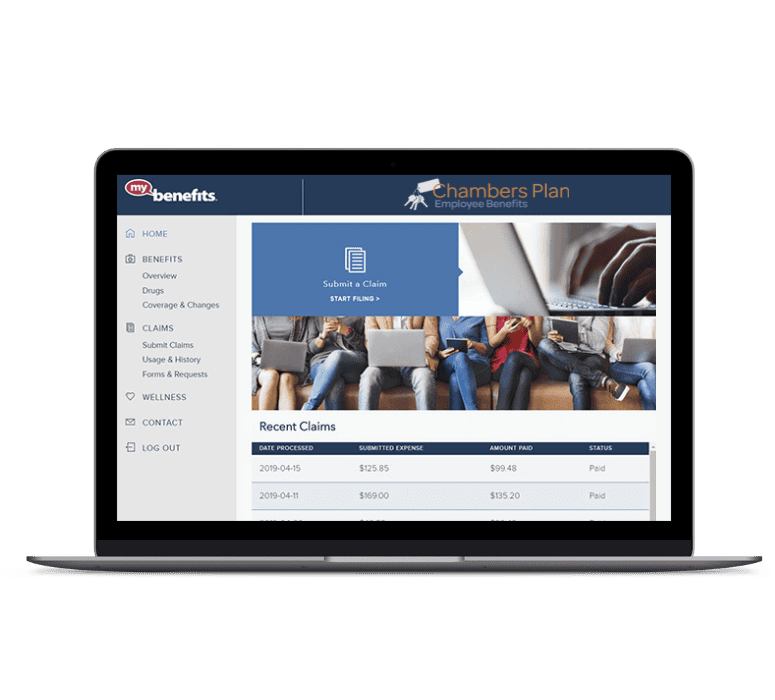

Easy and Quick Benefits Management

Experience the ease and efficiency of the “my-benefits®” online portal. Manage your plan, calculate payroll deductions, and access plan information anytime, anywhere. Empower your employees with seamless access to their plan details and claims usage.

Explore More Resources

Stay informed and make the most of your Chambers Plan with our valuable resources. Explore our blogs, newsletters, and guides to gain insights and updates on employee benefits, financial planning, and more.